Automate and accelerate customer service with AI-powered chatbots

Freshworks chatbots make great support possible 24/7, so businesses can delight customers with fast, personalized service on all their favorite channels.

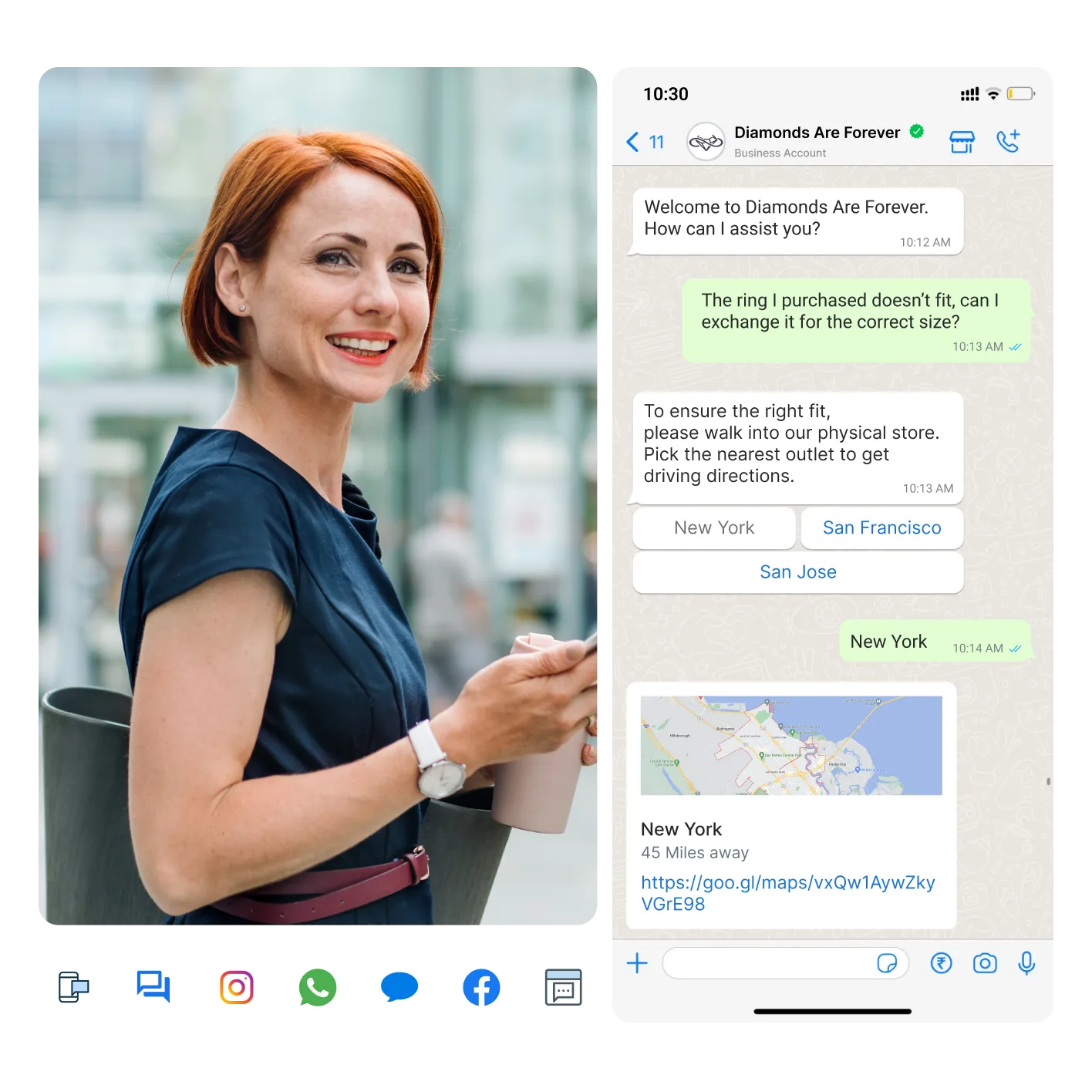

Smart chatbots for smooth multichannel engagement

Freshworks enables teams to deploy intelligent chatbots across channels such as the web, social media, or messaging apps. Freshworks chatbots can deliver fast, personalized service anytime without the need for a live agent.

Optimize operations. Scale support. Save money.

With Freshworks chatbots, support teams can handle more volume without more work. Businesses can keep operational costs in check with chatbots to handle growth—without compromising personalization and response quality.

No-code chatbot builder

With Freshworks’ built-in AI, businesses can create and customize no-code chatbots using natural language prompts and a drag-and-drop interface for granular control. Getting started is easy with out-of-the-box templates and training from a knowledge base or external sources.

Chatbot features

Provide instant self-service and delight customers with chatbots across all channels.

Intent detection

Understand customer issues and lead them to the right answer faster: Enable customers to ask their questions just like they would ask a human, and get personalized responses using built-in natural language capability.

More Freshworks customer service capabilities

Improve efficiency and deliver excellent support every step of the way, thanks to a powerful array of features and capabilities enhanced with AI.

Omnichannel CX solution

Engage customers wherever they are, including email, text, social, and other channels.

Advanced ticketing

Resolve customer issues faster with robust ticketing supported by AI and automation.

Self-service

Deflect customer queries 24/7 with quick-to-deploy, intelligent chatbots across channels.

Unified agent workspace

Bring data, tools, and processes together for maximum efficiency and convenience.

AI and automation

Built-in AI helps customers, agents, admins, and leaders do more with less time and effort.

Collaboration

Work together easily with communication, information, and automation, all in one place.

Intelligent insights and analytics

Stay ahead of emerging issues with proactive, AI-driven insights and next steps.

Streamlined admin

Take the pressure off admins with AI, workflow automation, and easy customizations.

Frequently asked questions on Freshworks chatbots

Find quick answers to common questions about Freshworks Chatbots

What is a chatbot in Freshworks?

Freshworks' AI-powered chatbot, as well as autonomous AI agents, are included in Freddy AI Agent which provides 24/7/365 support across multiple channels. It automates up to 70% of repetitive customer queries, reducing agent workload as support demands grow. Freddy also empowers customers to resolve issues independently, boosting self-service and overall customer satisfaction.

What are the key features of Freshworks’ chatbots?

Freshworks’ chatbots offer a range of features to enhance your business’s self-service capabilities:

Intent Detection: Understand customer intent and guide them to the correct solution.

Conversational Bot Builder: Create and deploy AI-powered chatbots quickly, with no coding required.

AI-Generated Answers: Provide real-time, accurate responses from your knowledge base and external sources.

Chatbot Templates: Use industry-specific templates and best practices to accelerate chatbot setup.

In-Depth Reports: Analyze customer interactions in real-time, identify issues, and optimize your support process.

Do Freshworks chatbots use AI?

Freddy AI, explicitly built for customer service teams, combines your data with Freshworks' industry-trained AI models. This allows Freddy AI to understand customer interactions, offering human-like insights and personalized resolutions. With strong security measures, Freddy AI ensures your data remains safe while enhancing customer satisfaction and delivering exceptional service.

Sign up for your free trial today

14 days. No credit card required. No strings attached.