Banking customer experience trends for 2025

Jun 26, 202410 MIN READ

In 2024, the consumer experience in banking is supported by interactions across various channels, digitally and in person.

While the traditional banking experience has been provided physically in a branch where employees can meet with customers face to face, the modern experience is much more dynamic, with most of it taking place online. Specifically, consumers of all ages are coming to recognize the convenience and accessibility of digital banking, driving some significant shifts in how banks deliver the customer experience.

To help you stay up-to-date on the latest in customer experience in banking, we’ve compiled some of the top trends below. These trends will be critical to monitor if you want to improve customer satisfaction, loyalty, and retention and compete in the digital age of banking.

What is customer experience in banking?

The customer experience (CX) refers to the sentiment among customers at every stage of the lifecycle, whether it’s when a customer opens up a new checking account, visits a branch in person to apply for a loan, or reaches out to customer service for assistance online for a problem they’re having while making a payment.

At every corner, the bank has the opportunity to foster a positive experience for the customer, helping them feel pleased about their choice to bank with the institution. Otherwise, an experience that is inconvenient or difficult to navigate can result in feelings of frustration or mistrust for the bank.

Every interaction between the bank and the customer contributes to the overall experience, so each touchpoint can be fully optimized with the latest trends and techniques to help improve the customer’s perception.

The 7 most important customer experience trends in banking for 2025

Banks must constantly upgrade the customer experience to stay relevant and continue earning their customers’ loyalty. Though trends in this space can change quickly, those who can stay at the forefront of innovation and promptly adapt to consumer demands will be better equipped to come out on top.

We will now examine more in-depth the emerging trends impacting the customer experience in banking this year.

1. Mobile customer service

Consumers today, particularly those in the younger generations, increasingly rely on their mobile devices to connect with service providers–including their banks. Specifically, nearly half, or 48%, of bank customers list their phone as their preferred option for managing their bank accounts.

From viewing their account balances to seeking support for a billing issue, many banking customers find it more convenient to do so from their mobile devices rather than visiting a branch in person or calling over the phone.

In other words, banks that offer customer service through a mobile app, SMS, or online portal can better meet the needs and expectations of modern consumers. It’s a more accessible and convenient way for customers to contact the bank on the go, supporting a better overall experience and helping institutions stand out in the saturated market.

2. Personalized experiences

Banks have traditionally taken a one-size-fits-all approach to products like checking accounts or loans. However, institutions now see consumers' importance on personalization, which can increase retention and decrease acquisition costs.

Doing so has important implications for the bank’s bottom line, as a recent study shows that 82% of consumers say personalized experiences influence which brand they select in at least half of all purchases.

Banks can leverage the vast amount of consumer data available today to offer customers a more tailored and personalized experience. This might mean a bank offers personalized financial advice and product recommendations based on the customer’s financial situation, goals, and life stage. Or, they may offer personalized rewards or incentives based on the customer’s spending patterns.

3. AI and automation

The application of artificial intelligence (AI) and automation tools in the financial services space has grown rapidly over the past few years. In 2024, the adoption of AI technology in banking is only set to increase, fundamentally shifting how the industry operates.

These technologies help banks be more efficient with their resources, lessening their dependence on time-consuming and repetitive tasks and allowing them to spend more time with customers.

Additionally, because of its superior computing capabilities, AI technology can process and analyze data more accurately than standard employees. In turn, there is less risk of human error that can detract from the customer experience, like if data from their loan application is submitted incorrectly and keeps them from qualifying. All in all, AI and automation make for more streamlined and efficient banking workflows, resulting in a more convenient customer experience.

4. Security concerns

Emerging technologies can be used to make the banking customer experience better, as we discussed above. However, fraudsters can also use innovative tech like AI and automation for their own gain. Unfortunately, consumers’ bank accounts are a major target for bad actors who want to make an unauthorized transaction or transfer the victim’s funds to their own account.

Thus, in 2024, there is a large focus on data privacy and account security in the banking industry, with consumers expecting their banks to implement robust safety measures to keep their accounts protected and free from fraudulent activity.

The good news is that banks don’t have to compromise on a seamless customer experience in order to bolster their online security framework. Identity verification methods like biometric authentication or two-factor authentication are simple to use and effective at proving users are the rightful account owners. So, this can strengthen customers’ confidence in the institution when they believe their bank is taking the appropriate measures to keep their accounts safe.

5. Conversational and emotional experiences

Another pertinent trend taking hold in banking is consumers’ desire for more emotional and engaging interactions with their banks. This can be an effective tool to foster better loyalty and trust from customers and helps banks ensure they can meet their needs and expectations. While still important, banking customers aren’t just shopping around to find the bank that offers the most competitive rates. They want to work with an institution that they feel understands their desires and wishes, and will go the extra mile to support their goals.

Customers in 2024 don’t want to feel like just a dollar amount to their bank, they want to be treated like a unique person with specific financial needs and interests. In sum, a positive, personal experience with a bank can be extremely memorable, fostering more lifelong customers.

6. Real-time assistance

An overarching trend for the customer experience in banking this year is better convenience, meaning customers expect prompt, real-time assistance for their concerns or inquiries. In other words, it’s no longer acceptable for customers to submit a request form or send an email and get a response back in two to three business days.

Given the accessibility of the Internet and digital banking platforms, customers expect their banks to be highly responsive, providing them with the information they need when they require it. Whether a bank uses AI-powered chatbots or a 24/7 call center, offering real-time assistance is a pillar of the modern customer experience and helps banks improve customer satisfaction. Banks that fail to address this customer demand may be at risk of losing market share over the coming years.

7. Easy accessibility

Lastly, consumers’ desire for ease of use spans across all industries, even when it comes to complex financial products. So, even if a bank is embracing digital transformation trends by rolling out a new mobile app, they need to ensure they have an intuitive, easy-to-use design that doesn’t take away from the mobile banking experience.

For banks to nail the customer experience in 2024, they need to have a platform that is easy to navigate and allows customers to always find the exact information they need independently. It’s not simply enough to be present online–the digital experience should be seamless and use intuitive designs so customers of all technological capabilities and familiarity can successfully navigate the platform.

Benefits of understanding customer experience banking trends

Banks have a lot to gain by investing in their customer experience, especially in 2024. In the modern landscape, offering a customer-centric approach is the industry standard and not something that banks can put on the back burner.

The customer experience is a core aspect of what drives retention and growth–along with offering consistent, secure, and reliable banking products. The following are some of the main benefits that come from staying up-to-date on banking customer experience trends.

Customer satisfaction and loyalty

Providing a quality experience drives better loyalty and retention among customers. This is possibly the largest benefit to banks, as it directly impacts their bottom line. Customers stay with the bank longer, earning them higher revenues through fees and interest over the duration of their banking relationship. In fact, according to research done by McKinsey & Company, the banks that lead in customer satisfaction also show better financial metrics like higher growth and total shareholder return.

Plus, satisfied customers are more likely to recommend the bank to their friends and family, further driving their revenue growth. Banks that implement the latest technology and systems to create a frictionless, convenient customer experience will notice their customers are more satisfied with the banking experience, as they can access the information and services they need, when they need it.

Brand awareness

A bank that offers a competitive selection of financial products and services is viewed positively in the marketplace. However, a bank that is widely known for its premium customer experience will also help to differentiate itself and create a brand that is synonymous with being customer-centric.

This can make consumers feel more familiar with the bank, creating an easily recognizable brand that customers associate with a positive banking experience. In other words, when a consumer thinks of a specific bank, what comes to mind first? By adopting the latest trends in customer experience, banks can gain a reputation for being innovative and convenient rather than clunky and outdated–which is appealing to modern consumers.

Competitive advantage

In addition, offering a seamless customer experience with the latest trends and innovations can help banks hone their competitive edge in the marketplace. With growing competition from large incumbents and digitally-native new entrants, banks cannot remain stagnant and must focus on new ways to improve the customer experience and stand out from their peers.

With so many banking options available today, it’s easy for customers to transfer to a competing bank if they’re not feeling satisfied with their current provider. Thus, staying on top of what’s new in customer experience can help banks stand out in the crowded marketplace, becoming more attractive to both new and existing customers.

Streamlined operations and cost-effectiveness

When a bank’s customers have stronger loyalty and less turnover, it can positively impact their profitability and efficiency. This is because a good customer experience reduces the bank’s customer acquisition costs as they don’t have to spend as much attracting new customers.

A seamless experience also allows customers to easily access the information they need to troubleshoot problems or resolve issues on their own, reducing the bank’s need to pay for extensive customer support. In turn, this translates to additional cost savings and operational efficiencies for the bank, allowing them to reinvest in more profitable and strategic initiatives.

Challenges of providing quality customer experiences in the banking industry

Customer experience trends in banking are constantly evolving, which can provide some complications as institutions aim to address the unique demands of the modern marketplace, including the following. The customer journey for onboarding, banking services management, ATM requests, and other banking CX needs can be quite cumbersome.

Integration

A bank may find it difficult to implement modern technologies and customer service solutions within its existing tech stack. If they’re still relying on legacy programs to manage certain aspects of their operations, implementing new technologies may require a more strategic approach with plenty of time and resources allotted for strategic planning and data transfers.

Banks will need to find solutions that are agile and meet the dynamic needs of modern customers but are compatible with their existing systems for minimal business disruption during implementation.

Security concerns

As we mentioned earlier, the negative consequence of the banking experience going increasingly digital is that it will be easier for fraudsters to access consumers’ sensitive financial data and bank account information. Plus, consumers may not feel comfortable with the growing volume of personal data that their banks collect, use, and store.

Thus, data security concerns may remain an important roadblock for banks to overcome if they want to leverage the full benefits of a digital banking experience. To appropriately meet customer expectations, banks will need to implement robust safety measures like encryption, thorough audit trails, and strong authentication mechanisms.

Compliance

The financial services industry is already highly regulated, and as the industry grows more digital, compliance standards will only become more stringent. For banks, it’s a delicate balance to implement the right safeguards and practices to meet regulatory requirements like Know-Your-Customer (KYC) and Anti-Money-Laundering laws without compromising the customer experience.

How can Freshworks enhance your customer experience capabilities?

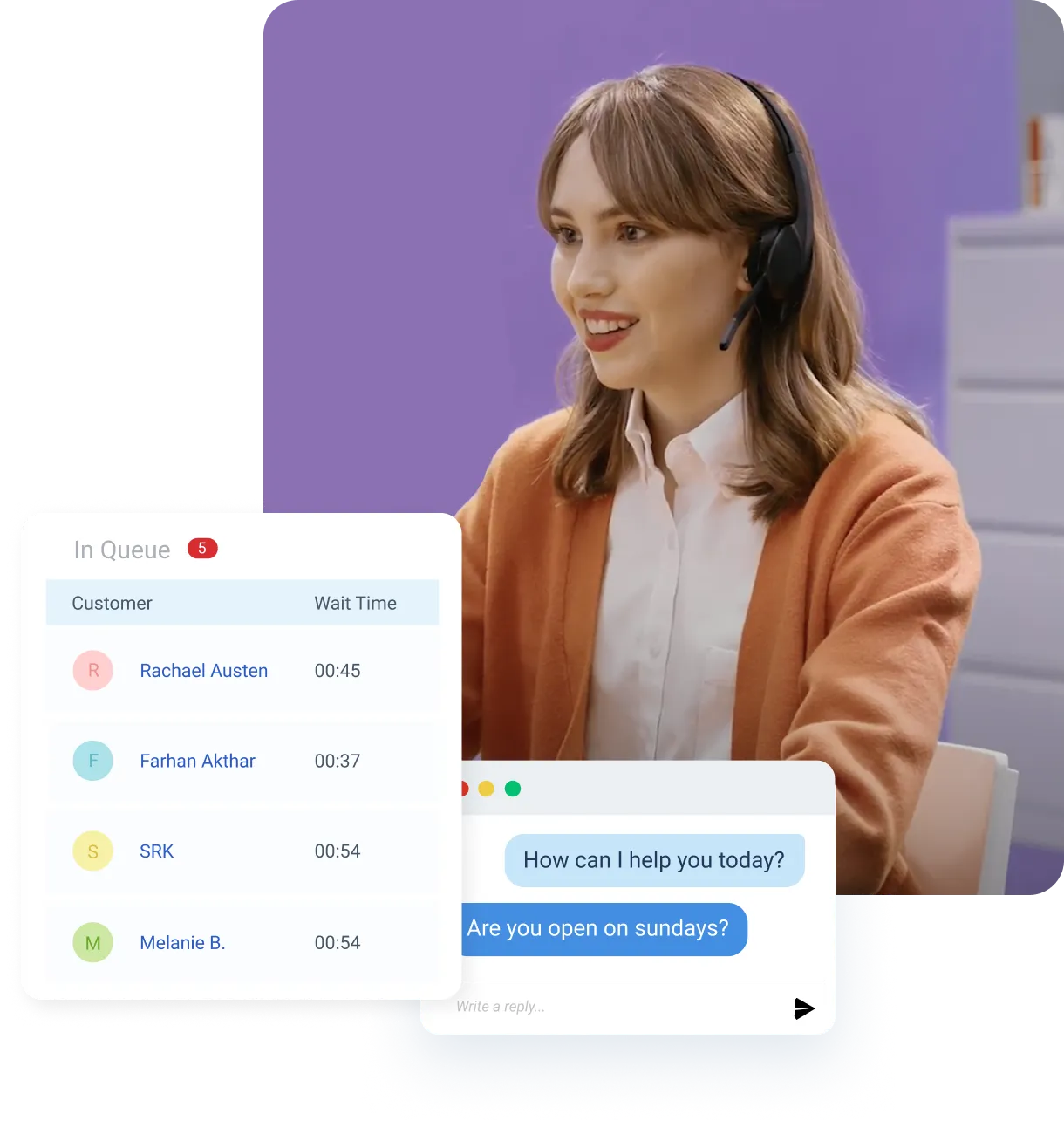

Freshworks is an AI-powered omnichannel solution for managing customer service. Banking staff can use 24/7 multichannel intelligent chatbots, advanced ticketing supported by automation and AI, AI-driven analytics, and more to create improved customer experiences. Its smart ticketing, integrated AI, integration capabilities, and customizable self-service portals allow banking teams to manage inquiries and resolve issues promptly efficiently.

Freshworks is a leading provider of customer engagement software dedicated to assisting businesses like banking institutions with delivering exceptional customer experiences. Through its suite of products, Freshworks enables banks to easily connect with customers and effectively meet their needs.

FAQ

Why is personalization so important for customer experience?

Personalization can enhance the customer experience by providing product recommendations and campaigns that are directly tailored to the customer’s wants and needs. In turn, customers feel like their bank is paying attention to their desires, fostering more loyalty and satisfaction throughout the experience.

How are banks leveraging data analytics to enhance customer experiences?

Banks that leverage data analytics can process large volumes of data more accurately and efficiently. The implications of this technology are widespread, as banks can offer customers more speedy, accurate, and personalized recommendations, all of which can enhance the customer experience.

Should customer feedback be utilized when curating customer experiences?

It’s important to consider customer feedback when curating the customer experience because it ensures the bank is aligned with the customer’s expectations and demands. Throughout the feedback process, banks can recognize the specific aspects of their experience that are detracting from customer satisfaction and could be improved.

How can AI be leveraged to optimize customer experience?

There are many applications of AI that can help banks enhance their customer experience, including through the use of AI-powered chatbots to offer around-the-clock support, more accurate data processing, enhanced personalization capabilities, predictive analytics to help detect and prevent fraudulent activity, and more.

Customer service software

Learn more about customer service software through our ultimate guide, and take a look at the top customer service tools of 2024 to choose from.

Freshdesk Omni product tour

Experience an interactive product tour of Freshdesk Omni before your personalized demo and explore the capabilities of Freshdesk Omni.

Customer engagement platform

Click here to cover what defines a customer engagement platform, its operations, benefits,, and leading customer engagement platforms in 2024.

Customer feedback software

Explore our comprehensive guide on customer feedback tools, which provides insights into the top customer feedback software of 2024.

Customer experience software

Take a look at our exclusive guide on customer experience management tools, which provides insights into the top customer experience software of 2024.

Try the all-in-one customer service solution

Start your free trial today. No credit card required.